"私募基金大数据报告"相关数据

更新时间:2022-04-202019年全球时尚及奢侈品行业私募基金和投资者调研

Preface

During 2018, Fashion & Luxury (F&L) grabbed the attention of PE funds and Investors. Some have raised special vehicles to be on top of trends and to recognise the best assets in the industry.

Valuations have grown high and this has shone the spotlight on the F&L industry, despite market challenges such as disruptive technologies and new competitivelandscapes.

PE funds and Investors have faced increasing competition from strategic buyers, that pursue strong buy-and-build strategies to consolidate their businesses and to survive market transformation. Competition has also extended geographically, with increased interest from Asia and Middle East.

In this context, global investors interested in the Fashion & Luxury industry are reviewing their expectations and strategies for the next years.

In order to analyse and measure market trends and expectations on M&A activities, Deloitte has launched the fourth edition of the“Global Fashion & Luxury Private Equity and Investors Survey".

【更多详情,请下载:2019年全球时尚及奢侈品行业私募基金和投资者调研】

截至2022年2月中国国资背景机构通过私募股权投资过的国外公司(部分)该统计数据包含了截止2022年2月中国国资背景机构通过私募股权投资过的国外公司(部分)。其中GRAIL投资金额3亿美元。2015-2021年发布时间:2022-04-20

截至2022年2月中国国资背景机构通过私募股权投资过的国外公司(部分)该统计数据包含了截止2022年2月中国国资背景机构通过私募股权投资过的国外公司(部分)。其中GRAIL投资金额3亿美元。2015-2021年发布时间:2022-04-20 2013-2019年数据服务领域在全球各地区投资公司的轮次情况该统计数据包含了2013-2019年数据服务领域在各地区投资公司的轮次情况。北京A轮公司数量为158家,B轮公司数量为39家,C轮公司数量为14家。2019年发布时间:2020-07-16

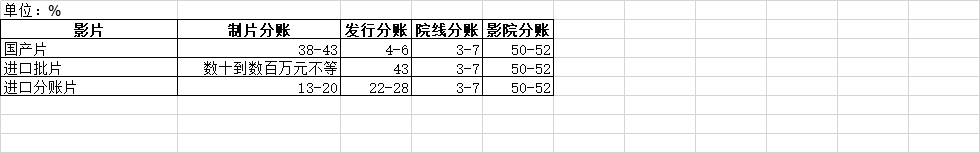

2013-2019年数据服务领域在全球各地区投资公司的轮次情况该统计数据包含了2013-2019年数据服务领域在各地区投资公司的轮次情况。北京A轮公司数量为158家,B轮公司数量为39家,C轮公司数量为14家。2019年发布时间:2020-07-16 截至2011年中国电影票房分账比例情况该统计数据包含了截至2011年中国电影票房分账比例情况。其中国产片、进口批片、进口分账片影院票房分账比例为50-52%。2011年发布时间:2020-06-24

截至2011年中国电影票房分账比例情况该统计数据包含了截至2011年中国电影票房分账比例情况。其中国产片、进口批片、进口分账片影院票房分账比例为50-52%。2011年发布时间:2020-06-24